Deciding to sell your business is one of the most important professional decisions you will make in your life. For most business owners, their business is their identity, their ‘baby’, and in many cases the team may be family or viewed as family. For many business owners, there is also a commitment to the local community. Deciding to sell is a big deal filled with emotion and uncertainty including wondering what the next phase of life will bring.

But, planning your exit should not be scary.

With October here, the scary decorations abound with ghosts and goblins hanging from trees and adorning front yards. Halloween parties are scheduled, and our economy receives a significant boost from Halloween-related spending.

Leave the fright to the trick-or-treaters and put together an exit plan.

Are you thinking about selling your business?

If so, don’t go on this journey alone. Just like trick-or-treating, there is safety in numbers. This is not the time to venture down this path on your own. This is the time as a business owner where you call in your team and surround yourself with trusted advisors to help from step 1 through the finish. They will help keep the goons and goblins away.

Your team should include your CPA, business attorney, and your financial planner or wealth manager. If your team needs shoring up, we can certainly discuss introducing you to select professionals in our network to build the right team.

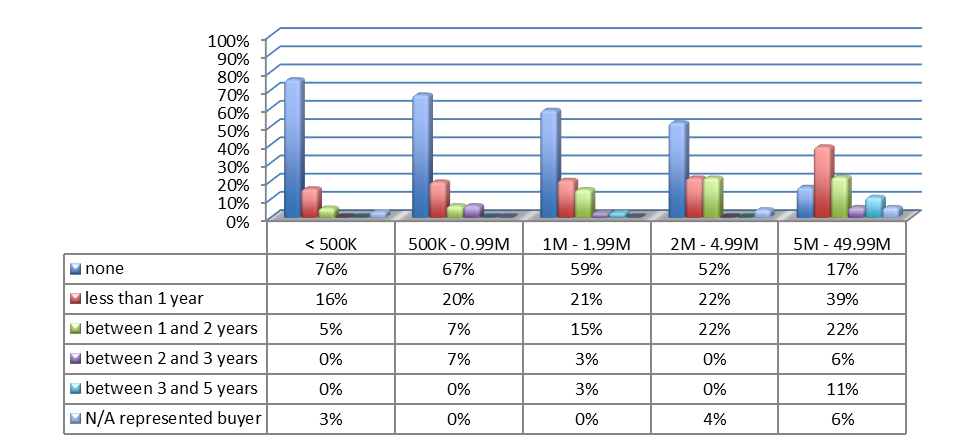

The IBBA (International Business Brokers Association) and M&A Source publish a quarterly Market Pulse report of results from surveys from those involved in selling businesses across the country. The statistics are particularly insightful with respect to exit planning. The latest report, for Q2 2024, shows most business owners did no formal exit planning prior to engaging to sell their business. Only in larger businesses with revenues of $5M to $50M did 28% of the respondents complete formal exit planning. Few of the business owners met with their advisor (wealth, CPA, or attorney) before engaging a business broker to sell their business.

There are many conclusions that can be drawn from this data, but one likely conclusion is that owners are busy, and do not have or have not made the time to think about planning an exit strategy. Akin to estate planning and updating one’s will, there are many other priorities to place as higher importance than what may feel like planning your death. Another likely conclusion is that business owners are unsure what exit planning looks like including the important elements to have in place prior to selling and moving onto their next phase of life.

Think of the upside of planning.

Remember that saying, proper planning prevents poor performance?

This adage is true in business including selling your business. Planning gives you options. Planning gives you peace of mind. Planning gives you a general timeline to work within. Planning gives you some structure and guardrails. Simply, planning puts you squarely in the driver’s seat.

Exit planning should not be scary. In fact, not having as plan should be the scary situation.

Today’s market is a seller’s market. There are fewer businesses on the market. The election is adding caution as some sellers choose to defer to see the election result and the impact on taxes and interest rates. Prospective buyers need to have financing secured and have their ducks in a row to compete with dozens of signed NDAs and aggressive offers. This presents a great opportunity for business owners thinking of selling. Potentially, you have a great opportunity, or you may not be as well positioned as you should be to take advantage of the market. Where would you land on this spectrum?

When is a good time to plan?

According to the most recent IBBA and M&A Source Market Pulse report, any advance planning will position you as better prepared than most business owners. For businesses with revenue $2M to $5M, 52% did no exit planning prior to marketing their business for sale. In that same category 22% prepared between 1 and 2 years.

Amount of Exit Planning Prior to Marketing Your Business

Source: IBBA and M&A Source Market Pulse Q2 2024

Stare Down the Dragon and Start Putting a Plan Together.

Our recommendation is start now to put a plan together. What timeline are you thinking about? What is your financial situation? Schedule an initial meeting with your trusted advisors – wealth, CPA, and attorney.

If you have gaps in your trusted advisor circle, reach out to others you trust to help you fill in those gaps. We regularly help our clients build the right team to plan their exit.

As business brokers, we can assess if now is a good time to go to market or if you have work to do to better position your business for sale. We understand there may be extenuating circumstances affecting your timing, but if you have more flexibility in your timeline, there are steps you can take that will put you in a stronger position to go to market.

We offer to meet with you; these initial meetings can be incredibly useful to answer any questions you have regarding the process of selling your business as well as enabling us to review your business and perhaps identify areas of your business that need some ‘shoring up’ in advance of going to market.

Most business owners want to be in a position of strength when it comes to selling. Meeting well in advance (the 1-2 year timeline) is typically a great time for an initial meeting to give you the runway your business may need to be ready to go to market. Areas that may need time include operational areas, systems and technology, and cleaning up your balance sheet and P&L to put you in a stronger position.

Stare down the dragon and get your team of advisors around you to ward off the goons and goblins and get you positioned to maximize the return on your years of hard work.

If 1-2 years is too long for you to wait to get out of Dodge, let’s schedule a meeting with your team to start putting an action plan in place. With the right team in place, the vultures will be kept at bay, you will have a better sense of the value of your business, and you will have confidence that you are not leaving money on the table or limiting your options. Afterall, you have worked hard to get where you are. You deserve to complete the effort through properly positioning your business for the next phase and protecting all those you have worked hard for, including your team and the community.

With the right team, it is not scary. Your hard work will be rewarded with treats.